Payroll deduction online calculator 2023

That result is the tax withholding amount. Subtract 12900 for Married otherwise.

Cra Online Calculator Cheap Sale 60 Off Www Alforja Cat

Budget 2022-23 sumopayroll.

. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown. Then look at your last.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. And is based on the tax brackets of 2021 and.

Paycheck after federal tax. Ad Process Payroll Faster Easier With ADP Payroll. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Ad Plus 3 Free Months of Payroll Processing. Discover ADP Payroll Benefits Insurance Time Talent HR More. Form TD1-IN Determination of Exemption of an Indians Employment Income.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Boost Your Business Productivity With The Latest Simple Smart Payroll. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings.

Under 65 Between 65 and 75 Over 75. Taxes Paid Filed - 100 Guarantee. The US Salary Calculator is updated for 202223.

Get Started With ADP Payroll. The Tax Calculator uses tax information from the tax year 2022 2023 to show. Ad Process Payroll Faster Easier With ADP Payroll.

It can also be used to help fill steps 3. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

About the US Salary Calculator 202223. Free Unbiased Reviews Top Picks. Web UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. Get Started With ADP Payroll. 2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations.

2023 Paid Family Leave Payroll Deduction Calculator. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Get your business set up to run payroll Figure out how much each employee earned.

To calculate your annual salary. Get Started With ADP Payroll. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Our W-4 Calculator can help you determine how to update your W-4 to get your. Prepare and e-File your. Use our employees tax calculator to work out how much PAYE and UIF tax you.

Use our employees tax calculator to work out how much PAYE and UIF tax. The Tax withheld for individuals calculator is. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Start the TAXstimator Then select your IRS Tax Return Filing Status. Subtract 12900 for Married otherwise.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

2022 Federal income tax withholding calculation. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross.

PCB Calculator Payroll EPF SOCSO EIS and Tax Calculator. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Get Started With ADP Payroll.

250 minus 200 50. Subtract 12900 for Married otherwise. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Daily Weekly Monthly Yearly. 2022 Federal income tax withholding calculation.

2023 Paid Family Leave Payroll Deduction Calculator. Ad Plus 3 Free Months of Payroll Processing. All Services Backed by Tax Guarantee.

Get Started With ADP Payroll. It will confirm the deductions you. Ad Easy To Run Payroll Get Set Up Running in Minutes.

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

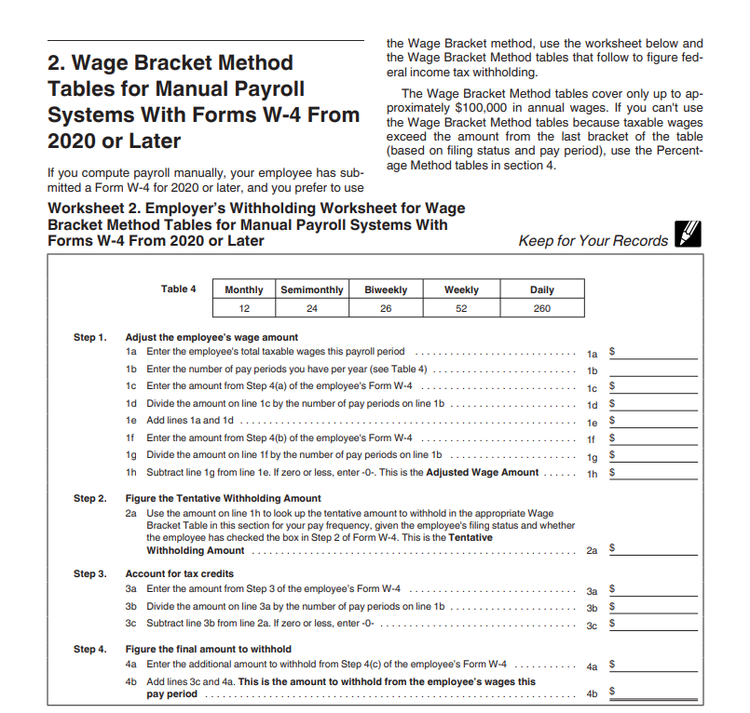

How To Calculate Payroll Taxes For Your Small Business

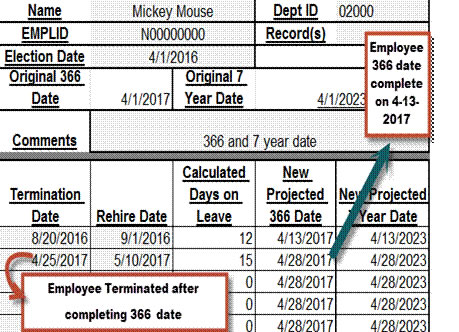

State Agencies Bulletin No 1527 Office Of The New York State Comptroller

Solved Federal Taxes Not Deducted Correctly

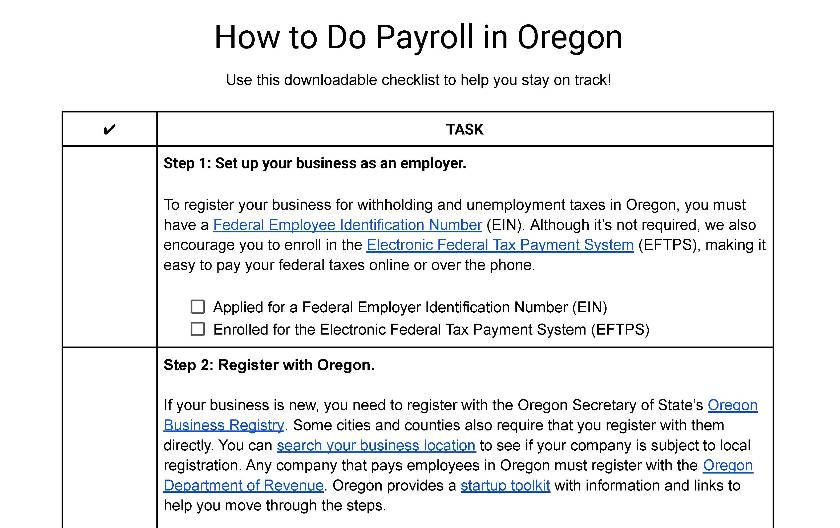

How To Do Payroll In Oregon What Employers Need To Know

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

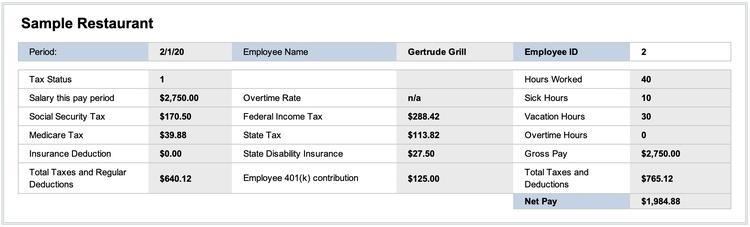

A Small Business Guide To Doing Manual Payroll

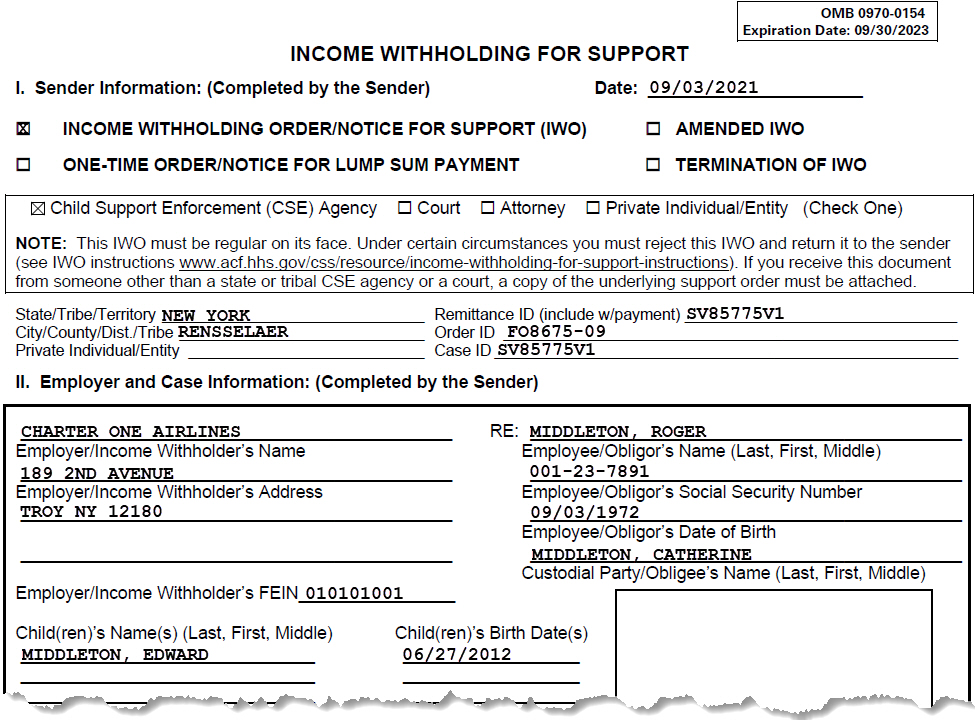

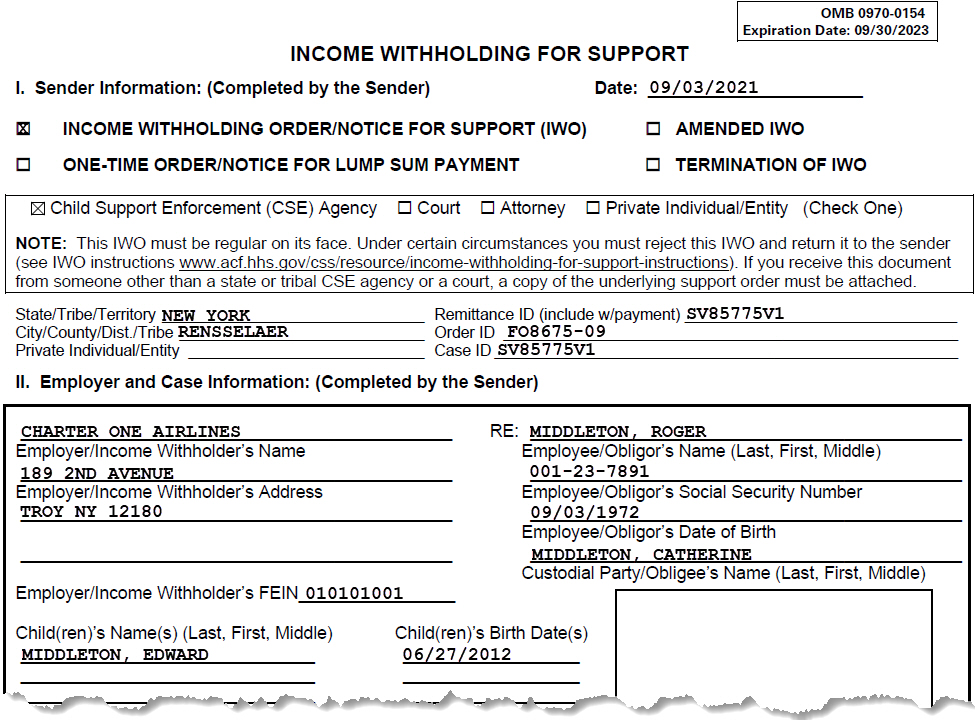

Nys Dcss Income Withholding Notice

How To Calculate Payroll Taxes For Your Small Business

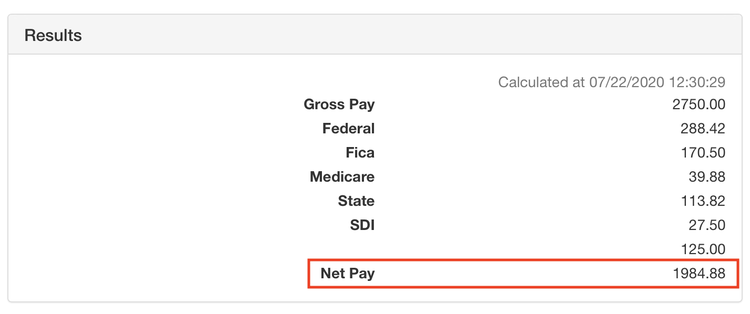

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

A Small Business Guide To Doing Manual Payroll

Llc Tax Calculator Definitive Small Business Tax Estimator

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

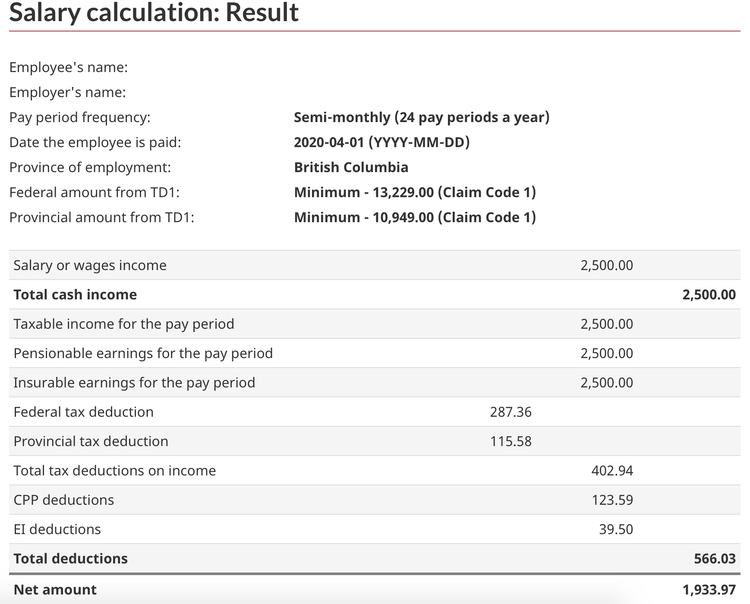

How To Do Payroll In Canada A Step By Step Guide

Payroll Template Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes For Your Small Business

When Are Taxes Due In 2022 Forbes Advisor